NZD/USD: an upward momentum maintains

04 January 2018, 12:44

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 0.7124 |

| Take Profit | 0.7200 |

| Stop Loss | 0.7055 |

| Key Levels | 0.6880, 0.6895, 0.6920, 0.6945, 0.6965, 0.7010, 0.7050, 0.7130, 0.7180, 0.7200, 0.7270, 0.7310, 0.7350 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 0.7110, 0.7070, 0.7050 |

| Take Profit | 0.7200 |

| Stop Loss | 0.7020 |

| Key Levels | 0.6880, 0.6895, 0.6920, 0.6945, 0.6965, 0.7010, 0.7050, 0.7130, 0.7180, 0.7200, 0.7270, 0.7310, 0.7350 |

Current trend

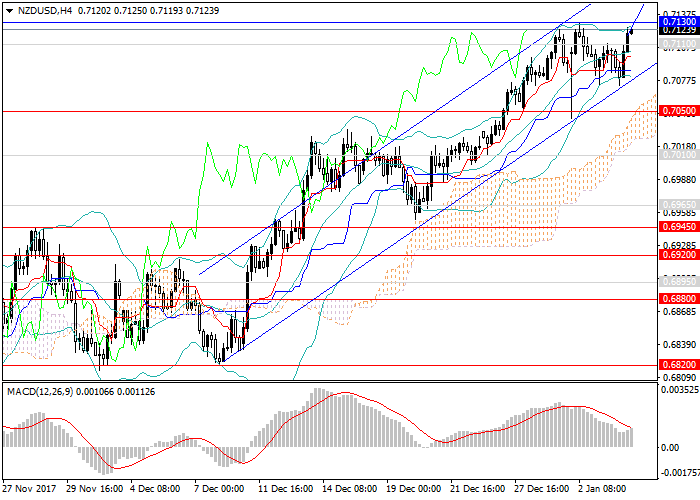

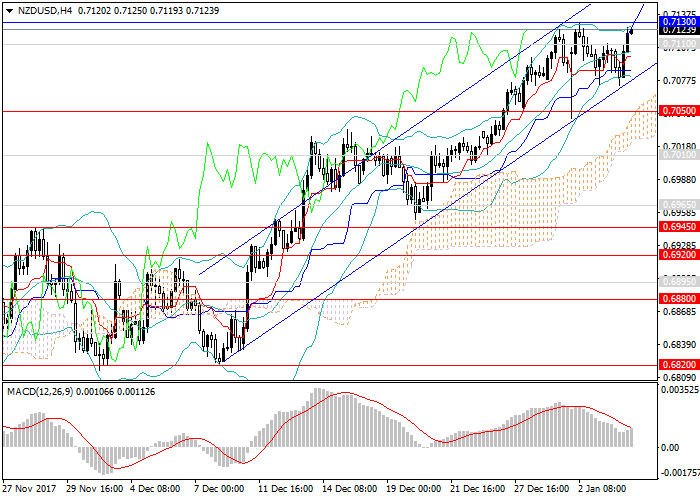

In December, New Zealand currency grew by more than 300 points against US dollar. In the beginning of the year, the pair entered the sideways consolidation, but the upward momentum has maintained. Today the pair has tested the local maximum and the key resistance level 0.7130 again.

Today and tomorrow the USA employment data releases, PMI and factory orders are worth traders’ attention.

Support and resistance

In the short term, the breakout of the key resistance level of 0.7130 and the growth to the new highs at 0.7180, 0.7200 (maximum of the middle of October of the last year) is expected.

Then the instrument will enter slow correctional movement, as the investors will close profitable positions and sell the pair. Technical indicators are restricting, grow signal changes into consolidation one, MACD reflects the rapid fall of short positions volumes, Bollinger Bands consolidated horizontally.

Resistance levels: 0.7130, 0.7180, 0.7200, 0.7270, 0.7310, 0.7350.

Support levels: 0.7050, 0.7010, 0.6965, 0.6945, 0.6920, 0.6895, 0.6880.

Trading tips

It’s better to increase the volume of long positions at the current level and open pending long positions from strong support levels of 0.7110, 0.7070, 0.7050 with the target at 0.7200 and stop loss at 0.7020.

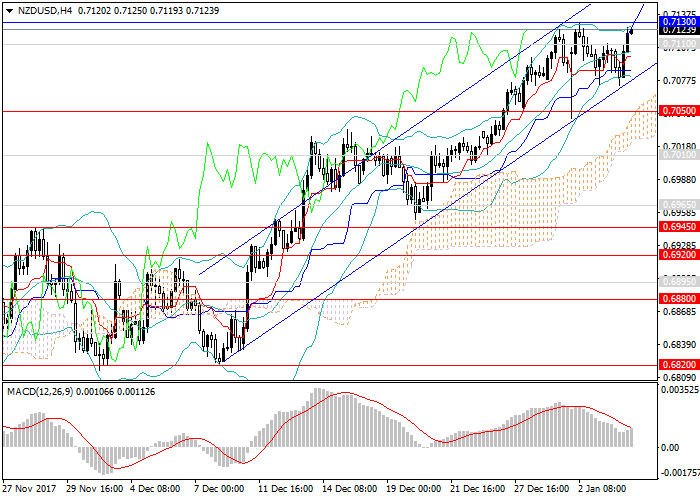

In December, New Zealand currency grew by more than 300 points against US dollar. In the beginning of the year, the pair entered the sideways consolidation, but the upward momentum has maintained. Today the pair has tested the local maximum and the key resistance level 0.7130 again.

Today and tomorrow the USA employment data releases, PMI and factory orders are worth traders’ attention.

Support and resistance

In the short term, the breakout of the key resistance level of 0.7130 and the growth to the new highs at 0.7180, 0.7200 (maximum of the middle of October of the last year) is expected.

Then the instrument will enter slow correctional movement, as the investors will close profitable positions and sell the pair. Technical indicators are restricting, grow signal changes into consolidation one, MACD reflects the rapid fall of short positions volumes, Bollinger Bands consolidated horizontally.

Resistance levels: 0.7130, 0.7180, 0.7200, 0.7270, 0.7310, 0.7350.

Support levels: 0.7050, 0.7010, 0.6965, 0.6945, 0.6920, 0.6895, 0.6880.

Trading tips

It’s better to increase the volume of long positions at the current level and open pending long positions from strong support levels of 0.7110, 0.7070, 0.7050 with the target at 0.7200 and stop loss at 0.7020.

0 Response to "NZD/USD: an upward momentum maintains 04 January 2018, 12:44"

Post a Comment