AUD/USD: general analysis

04 January 2018, 13:02

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 0.7850 |

| Take Profit | 0.7895 |

| Stop Loss | 0.7815 |

| Key Levels | 0.7730, 0.7780, 0.7812, 0.7855, 0.7895 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7780 |

| Take Profit | 0.7730 |

| Stop Loss | 0.7815 |

| Key Levels | 0.7730, 0.7780, 0.7812, 0.7855, 0.7895 |

Current trend

Today the AUD/USD pair continued to grow due to AiG Performance of Services Index reaching 52.0 points, which is by 0.3 points higher than the previous value.

US dollar was supported after US FOMC Minutes publication and the growth of Total Vehicle Sales growth. However, the pair strengthened again due to the growth of gold prices, which affects AUD significantly and are moving in the same direction in the long term.

Today the traders are focused on the US Initial Jobless Claims release at 15:30 (GMT+2), the volatility is expected to be moderate.

Support and resistance

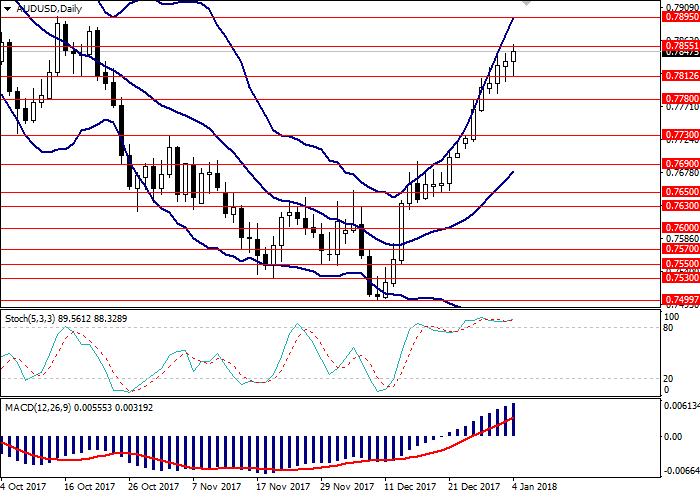

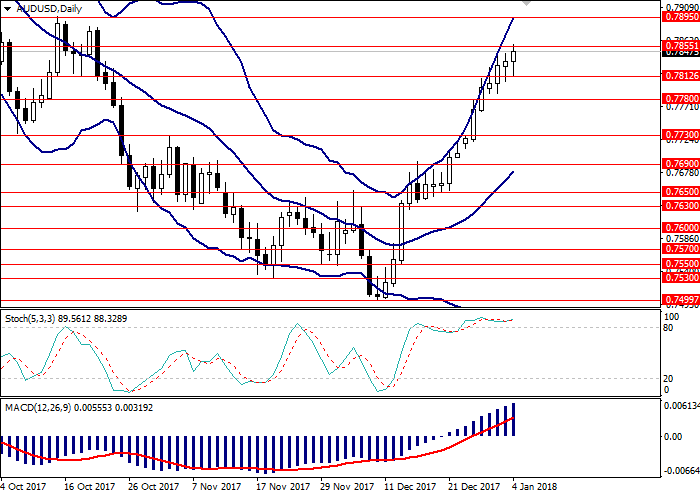

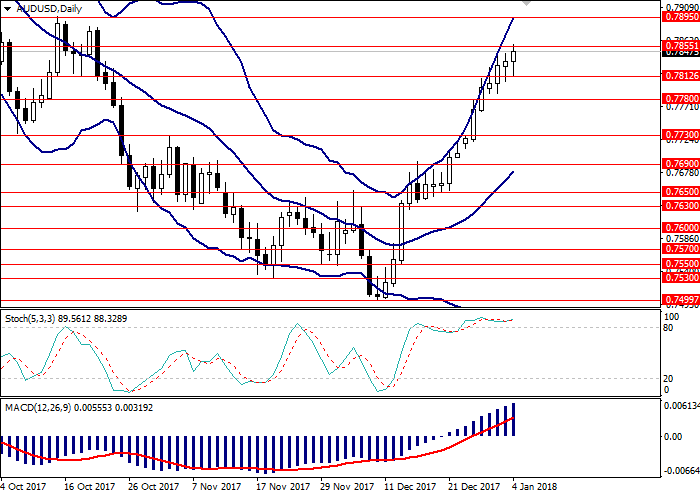

On the daily chart, the pair is growing along the upper border of Bollinger Bands. The price range is widened, which reflects the possibility of the upward movement development. MACD histogram is in the positive zone, the signal line crosses the zero one and the histogram’s body upwards, giving a signal to open long positions.

Resistance levels: 0.7855, 0.7895.

Support levels: 0.7812, 0.7780, 0.7730.

Trading tips

Long positions can be opened at the current level with the target at 0.7895 and stop loss at 0.7815. Implementation period: 1–3 days.

Short positions can be opened at the level of 0.7780 with the target at 0.7730 and stop loss at 0.7815. Implementation period: 3–5 days.

Today the AUD/USD pair continued to grow due to AiG Performance of Services Index reaching 52.0 points, which is by 0.3 points higher than the previous value.

US dollar was supported after US FOMC Minutes publication and the growth of Total Vehicle Sales growth. However, the pair strengthened again due to the growth of gold prices, which affects AUD significantly and are moving in the same direction in the long term.

Today the traders are focused on the US Initial Jobless Claims release at 15:30 (GMT+2), the volatility is expected to be moderate.

Support and resistance

On the daily chart, the pair is growing along the upper border of Bollinger Bands. The price range is widened, which reflects the possibility of the upward movement development. MACD histogram is in the positive zone, the signal line crosses the zero one and the histogram’s body upwards, giving a signal to open long positions.

Resistance levels: 0.7855, 0.7895.

Support levels: 0.7812, 0.7780, 0.7730.

Trading tips

Long positions can be opened at the current level with the target at 0.7895 and stop loss at 0.7815. Implementation period: 1–3 days.

Short positions can be opened at the level of 0.7780 with the target at 0.7730 and stop loss at 0.7815. Implementation period: 3–5 days.

0 Response to "AUD/USD: general analysis 04 January 2018, 13:02"

Post a Comment