EUR/USD: further growth of euro is expected

03 January 2018, 13:27

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 1.2013 |

| Take Profit | 1.2100, 1.2150 |

| Stop Loss | 1.1940 |

| Key Levels | 1.1730, 1.1800, 1.1830, 1.1950, 1.2000, 1.2030, 1.1860, 1.2075, 1.2100, 1.2120, 1.2150, 1.2175, 1.2280 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY LIMIT |

| Entry Point | 1.2000 |

| Take Profit | 1.2100, 1.2150 |

| Stop Loss | 1.1940 |

| Key Levels | 1.1730, 1.1800, 1.1830, 1.1950, 1.2000, 1.2030, 1.1860, 1.2075, 1.2100, 1.2120, 1.2150, 1.2175, 1.2280 |

Current trend

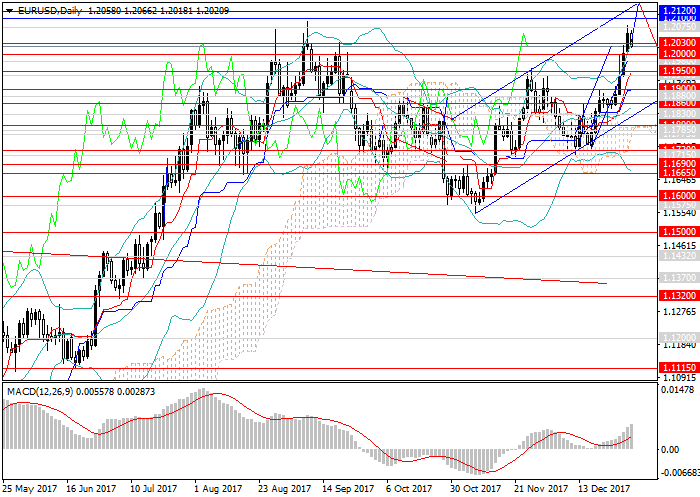

At the end of the previous week EUR against USD considerably strengthened in view of reduced demand for USD, positive statistics from Eurozone, and trading tendencies. During the last trading week of 2017 the pair gained over 200 points and practically reached the key resistance level of 1.2100 that is also the local maximum of early last September.

Today the instrument is moving to the downward correction stage. The pair has reached the first support level of 1.2030, and there is a chance of reduction to the next strong mark of 1.2000. The main catalyst of volatility growth may be the release of FOMC meeting minutes.

At the end of the trading week special attention should be paid to inflation data and key indexes of Eurozone. The USA will respond with labor market data and industrial orders.

Support and resistance

In the medium term the upward impulse is expected to preserve due to further reduction of USD rate. It should be mentioned that technically the pair remains in the wide upward channel and has not reached the upper border of the current trend. The next target level will be resistance at 1.2100. After it is reached, one may expect deeper downward correction. In this situation one may open long positions from the current level and 1.2100.

Technical indicators continue to give signals for the growth of the pair. MACD shows considerable growth in the volume of long positions in the recent trading days, and Bollinger Bands are still directed upwards.

Support levels: 1.2030, 1.2000, 1.1950, 1.1900, 1.1860, 1.1830, 1.1800, 1.1730.

Resistance levels: 1.2075, 1.2100, 1.2120, 1.2150, 1.2175, 1.2280.

Trading tips

In this situation long positions should be opened from the current level, and pending positions – from the level of 1.2000 with targets at 1.2100, 1.2150 and stop-loss at 1.1940.

At the end of the previous week EUR against USD considerably strengthened in view of reduced demand for USD, positive statistics from Eurozone, and trading tendencies. During the last trading week of 2017 the pair gained over 200 points and practically reached the key resistance level of 1.2100 that is also the local maximum of early last September.

Today the instrument is moving to the downward correction stage. The pair has reached the first support level of 1.2030, and there is a chance of reduction to the next strong mark of 1.2000. The main catalyst of volatility growth may be the release of FOMC meeting minutes.

At the end of the trading week special attention should be paid to inflation data and key indexes of Eurozone. The USA will respond with labor market data and industrial orders.

Support and resistance

In the medium term the upward impulse is expected to preserve due to further reduction of USD rate. It should be mentioned that technically the pair remains in the wide upward channel and has not reached the upper border of the current trend. The next target level will be resistance at 1.2100. After it is reached, one may expect deeper downward correction. In this situation one may open long positions from the current level and 1.2100.

Technical indicators continue to give signals for the growth of the pair. MACD shows considerable growth in the volume of long positions in the recent trading days, and Bollinger Bands are still directed upwards.

Support levels: 1.2030, 1.2000, 1.1950, 1.1900, 1.1860, 1.1830, 1.1800, 1.1730.

Resistance levels: 1.2075, 1.2100, 1.2120, 1.2150, 1.2175, 1.2280.

Trading tips

In this situation long positions should be opened from the current level, and pending positions – from the level of 1.2000 with targets at 1.2100, 1.2150 and stop-loss at 1.1940.

0 Response to "EUR/USD: further growth of euro is expected 03 January 2018, 13:27"

Post a Comment